How To Repair Your Credit: A Guide

Table of Content

Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. If you have cards open but you don’t use them, resist the temptation to close them. Closing credit lines lowers your available credit and increases your revolving utilization percentage. Instead, charge a small item – like a cup of coffee or a pizza dinner – once a month and pay your bill off immediately. Let’s review what a credit score is and how you can repair damaged credit to help you successfully buy your dream home. We know that untangling your credit can be both stressful and confusing.

If you're considering buying a house soon, now is the time to start repairing your credit. Contact us today for a free consultation with one of our credit experts. We can help you get started on the path to credit repair and homeownership.

Financial Risk Analyst

I can’t express enough how NB Credit Repair will make sure you have all the understanding you need when it comes to your credit. Grow your purpose-driven business with confidence and make a great living in the process. Enjoy an all-in-one solution to quickly run, and grow your very own business. Victoria Araj is a Section Editor for Rocket Mortgage and held roles in mortgage banking, public relations and more in her 15+ years with the company.

While you can repair credit reporting errors on your own and save money in the process, there are dedicated credit repair companies that can step in to help. While the success of credit repair companies is not guaranteed, this can make disputing errors and contacting each credit bureau a more pain-free experience. Making your payments on time is one of the most important things you can do to improve your credit score. If you have a lot of debt, you may want to consider consolidating your loans into one monthly payment. You'll be able to manage your finances better and raise your credit score as a result. Some credit repair companies offer programs that are designed specifically for home buyers.

How long does it take to improve your credit?

If you're thinking about using credit repair services to improve your credit score, it's a good idea to check with the major credit bureaus first. They may be able to provide you with free credit reports and credit counseling services. If you have poor credit but good income, credit repair may be just what you need to get approved for a home loan.

Credit counseling agencies are companies that can help you analyze your finances and find realistic solutions for your debt and credit issues. Credit repair companies look at your finances and suggest opportunities where you can save. They may also contact your creditors on your behalf and negotiate your payment amounts. Your credit is something that you control, and you can change your score for the better. After you understand your credit score calculation and you know your score, use a method or series of methods from our list to start improving your credit. If you want to have more confidence in your credit repair journey, look for a company that offers a money-back guarantee to hedge your bet.

Understanding Tri-Mortgage Credit Reports: Here’s What You Should Know

These services can help you save money by increasing your credit score and improving your credit profile. In some cases, they can even help you get a better rate on your loan. Customers have access to three separate packages and a free consultation to help them find the one that matches their needs. Packages start at $69.95 and go up to $119.95 with a startup fee that’s equivalent to the monthly fee for each service. The big plus to CreditRepair.com’s packages is that each includes credit monitoring, not something all credit repairs boast. Another good option is to consolidate your debts into one monthly payment.

Customers who choose one of its top two packages—the Prosperity Package or Success Package— will receive a Slash Rx discount to save up to 80% on medication. You make a hard inquiry on your credit report when you apply for a debt consolidation loan. This means that your credit score will usually drop by a few points immediately after your inquiry. Focus on making on-time payments above the minimum required amount after you get your debt consolidation loan. Your payment history is the biggest single factor that makes up your credit score because it comprises about 35% of your score’s calculation.

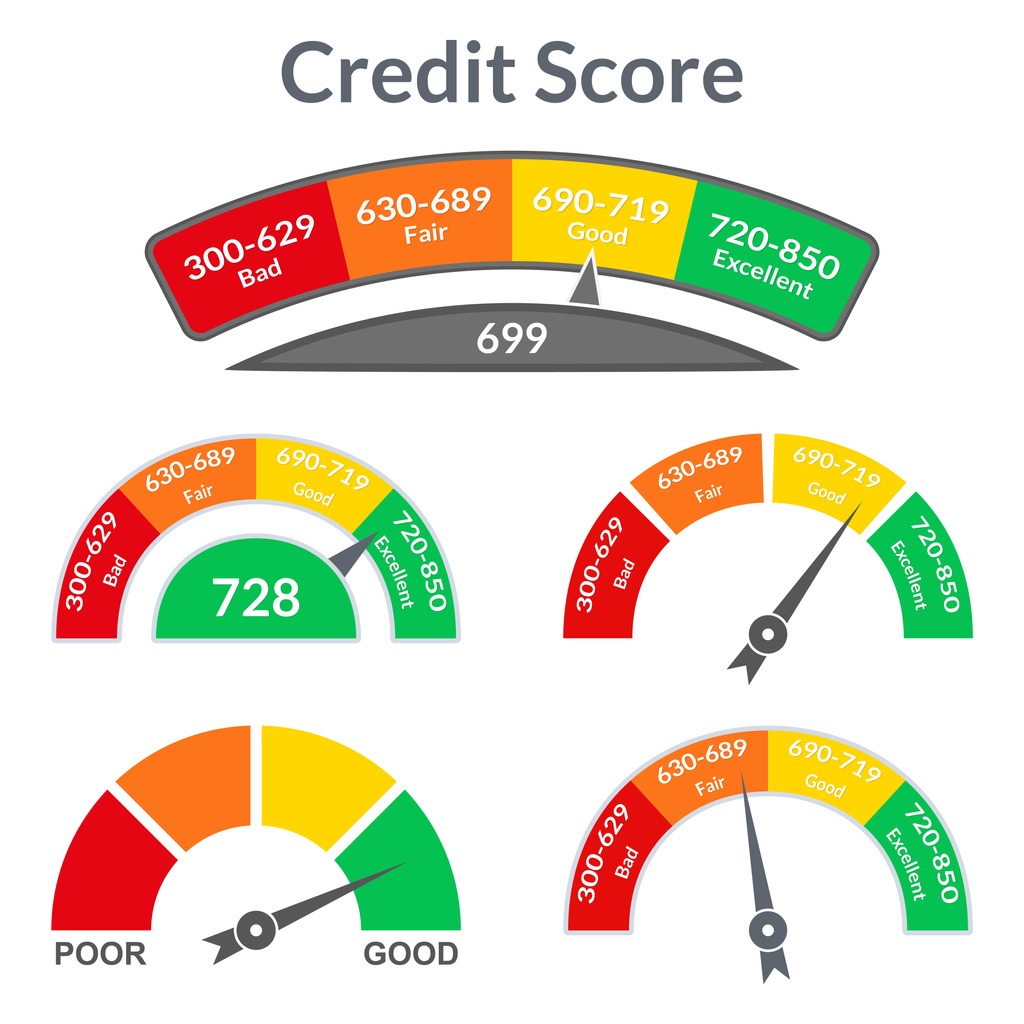

Each year we host the world's credit repair industry leaders to share with you EXACTLY what works and how to implement proven strategize in your business. Apply online for expert recommendations with real interest rates and payments. The U.S. Federal Trade Commission recommends that you should not have to worry about your credit score dropping after buying a house. Instead, they advise that buying a home is one of the best things you can do for your credit score. 850 is the highest possible credit score for both the FICO® and VantageScore 3.0 credit score models.

Send us a message today, and we can get you started on a path to financial confidence. Each situation is different, but most of our customers see results within days. Experian can help raise your FICO® Score based on bill payment like your phone, utilities and popular streaming services. Our ratings take into account the product or service's category-specific attributes.

You may still be approved for a mortgage if you have a low credit score, but the interest rate will likely be higher. Having a good credit score is essential when qualifying for a house loan. You may have to pay a monthly fee to participate in a credit repair program. First, we'll evaluate your credit history and dispute any incorrect findings. Then, we'll prioritize the actions that will improve your credit score the fastest. But did you know a low credit score can impact a lot more than just financing?

After you repair your credit, it’s crucial to practice healthy credit habits to keep your credit score and reports in shape. When comparing different companies or packages within one company, be sure to check if credit monitoring is included. Some companies include it at no additional cost, and others may require you to upgrade to a higher tier package to receive the service. Whether you’re looking to finance a home or take out another type of loan, it’s a good idea to work toward improving your credit.

I can honestly say yes am happier and more confident when I go out and make a purchase on credit. At NB Credit Repair We know that enjoying the finer things in life are important to you and your family. As a result of this, Our Board Certified Credit Consultants will utilize our expertise to help you restore, rebuild and raise your credit scores, so that you will become creditworthy again. It's software that makes it incredibly easy to run and grow your very own profitable credit repair business, or add an entirely new revenue stream to your existing business.

Mortgage lenders will also consider your income, employment history, and other factors when determining whether to approve you for a loan. All ratings are determined solely by the Forbes Advisor editorial team. We believe in maintaining a positive mindset, creating partnerships with a purpose, and always striving for significant outcomes. When you work with us; you should expect a collaboration with transparency and consistency. I was very scared to allow someone to touch my credit until I spoke with NB Credit Repair. She’s very professional, and answered all my questions in a timely manner.

Sky Blue Credit has been in operation for over 30 years and offers a unique, one simple credit repair service option. Its service includes everything a customer needs to find and dispute errors on their credit reports and repair their credit scores. Unlike other credit repair companies on this list, there are no upgrades needed to more expensive packages. First, reach out to a local credit repair company to help you dispute any inaccurate information on your credit file. This is the first step in increasing your credit score and improving your credit history. A credit repair program can help remove negative items from your credit report, which will help increase your available credit and improve your credit utilization rate.

You can do several things to improve your credit score before you apply for a mortgage. One of the best things you can do is dispute any errors on your credit report. You can also negotiate with creditors to remove negative items from your credit file. Credit repair is when consumers work with companies that specialize in removing errors from credit reports with the intent to increase their credit score. If you have errors on your credit report, which 34% of consumers do, according to a Consumer Reports study, you may want help to get it back on track.

Comments

Post a Comment